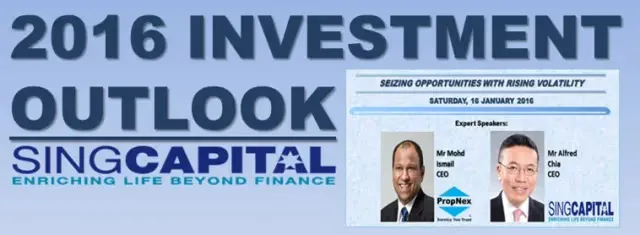

Seizing opportunities with Rising Volatility

Purpose of the event

For Investors who can stomach roller coaster rides, the China market has definitely put them through their paces. After rising by 154% from July 2014 to June 2015, it fell to prices that put Investors back where they started.

The sudden devaluation of the Chinese Yuan then added to the uncertainty already plaguing the global market.

Away from the Dragon, the Eagle of the West also added to Singaporean’s financial stress. With unceasing speculation that the US will hike up their interest rates, the expectations drove Singapore’s Interest and exchange rates to fluctuate.

After close to 7 years of near zero rates, the US Federal Reserve has finally begin its road to interest rate normalisation when it hiked rates up to a range of 0.25% to 0.50% on 16th December 2015.

How should Home Owners and Investors respond?

At home, Property Investors have not seen easy days either. Since Q2/2012, our property transactions have fallen by 93%, while the overall property prices have eased by 8% since reaching a peak in Q3/2013.

Will the downward local property trend continue?

Do not miss this opportunity to come and learn from the experts, who will share their thoughts on:

• The Impact of the rising Interest Rates;

• The Impact of the strong Singapore Dollar;

• The Outlook of the Property Market; and

• Global Investment Opportunities for 2016