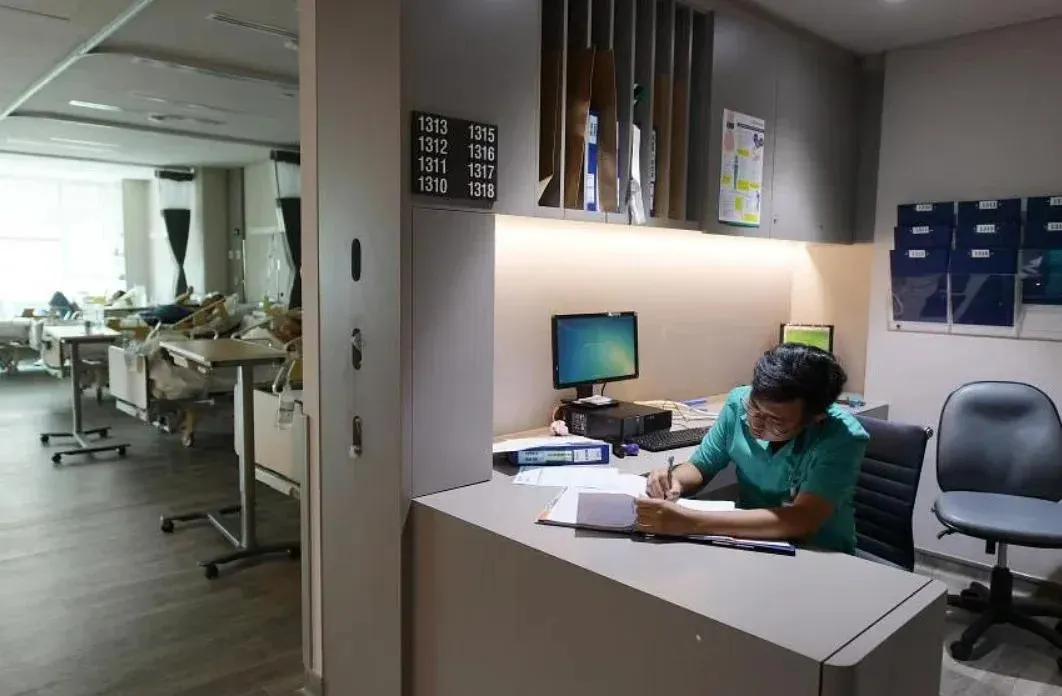

SingCapital CEO Alfred Chia shared his views on Integrated Shield Plans (IPs) for private healthcare

More than half who buy IPs for private healthcare opt for subsidised wards when hospitalized

Data from the Central Provident Fund (CPF) Board's healthcare financing website indicates that 57% of Singaporeans and permanent residents (PRs) with Integrated Shield Plans (IPs) choose subsidised care when they are hospitalised, despite having higher coverage.

Reasons for this include uncertainty of final bill sizes and long-term medication or treatment costs. When purchasing an IP, it is important to consider coverage and long-term affordability, as premiums can increase in the future and the basic MediShield Life, together with MediSave, cover bills for 70% of subsidised Singaporean patients.

Before making a decision, individuals should review their IP regularly to ensure it fits their health and financial profile.

"Mr Alfred Chia, chief executive of financial counselling firm SingCapital, said people may go for private care for some conditions, but turn to subsidised care for chronic problems."

"The IP pays for only the hospital component. If the person requires long-term medication or treatment, this comes from their own cash. Opting for subsidised treatment means they continue to pay subsidised rates for the follow-up, he added."

"Mr Chia said many people buy their IPs when they are young and the premiums are low. Since premiums are paid by MediSave, most do not think about it till they reach the age when they need to top up premiums with cash."

"He suggested that people review their IP regularly to see if it still fits their health and financial profile."

The CPF Board has stated that it would be economically beneficial for some individuals to purchase a lower-tier healthcare plan. Prof Lim has suggested that additional steps, such as the sharing of data, be taken in order to resolve the conflicting behaviour regarding future healthcare needs.

Source: THE STRAITSTIMES